What is ABC (activity based costing)? It is the collection of financial, operational, performance information tracing the significant activities of the firm to product costs in production management. In other words, the knowledge of find out estimates costs of production for product costs.

What does mean ABC (activity based costing)? Meaning, Definition, Features or characteristics, advantages, and disadvantages.

Activity-based costing (ABC) is a new term develop for finding out the cost. The basic feature of ABC is its focus on activities as the fundamental cost objects. It uses activities as the basis for calculating the costs of products and services. The Activity-Based Costing (ABC) is a costing system, which focuses on activities performed to produce products. ABC is the costing in which costs first trace to activities and then to products. This costing system assumes that activities are responsible for the incurrence of costs and create the demands for activities.

For example, an online learning firm prepares tax returns; suppose Udemy teaches online students. Fees charge to products based on individual product’s use of each activity. In the traditional absorption costing system, fees first trace not to activities but an organizational unit, such as a department or plant and then to products. It means under both, ABC and traditional absorption costing system the second and final stage consists of tracing fees to the course.

Definition of ABC (activity based costing):

What is the ABC (activity based costing) definition? The following ABC definitions below;

According to CIMA as;

“Cost attribution to cost units on the basis of the benefit received from indirect activities e.g. ordering, setting up, assuring quality.”

According to CAM-1 organization of Arlinton Texas as;

“The collection of financial and operational performance information tracing the significant activities of the firm to product Costs.”

It bases on the belief that in the production process various activities give rise to costs. Generally, Activity Based Costing (ABC) defines as an accounting technique that allows an organization to determine the actual cost associated with each product and service produced by the organization without regard to the organizational structure. Amongst various benefits associated with the ABC approach, one of the major ones is that it helps to define the activities of the organization in terms of value-adding activities.

Features or Highlights or Characteristics of ABC (activity based costing):

What are the ABC (activity based costing) features or highlights or characteristics? The following ABC features below;

- The simple traditional distinction made between fixed cost and variable cost is not enough to guide to provide quality information to design a cost system.

- It is a two-stage product costing method that first assigns costs to activities and then allocates them to products based on each product’s consumption of activities.

- They can use by any organization that wants a better understanding of the costs of the goods and services it provides, including manufacturing, service, and even non- profit organizations.

- The cost pools in the two-stage approach now accumulate activity-related costs.

- An activity is any discrete task that an organization undertakes to make or deliver a product or service.

- It bases on the concept that products consume activities and activities to consume resources.

- The more appropriate distinction between cost behavior patterns is scale related, scope related, decisions related, and time-related. In other words, cost behavior is all performance-related product costs.

- Cost drivers need to identify. A cost driver is a structural determinant of cost-related activity. The logic behind this is that cost drivers dictate the cost behavior pattern. In tracing overhead cost to the product, a cost behavior pattern must understand so that appropriate cost drivers could identify.

ABC cost method is activity-based cost management:

What is activity-based cost management? Cost management is an accounting method that calculates material costs, labor costs, management costs, financial costs, etc. according to certain standards by the current accounting system.

This management approach sometimes fails to reflect the direct link between the activities undertaken and costs. Also, the ABC cost method is equivalent to a filter. It readjusts the original cost method so that people can see the direct connection between the cost consumption and the work they engage in so that people can analyze which cost inputs are effective. Which cost inputs are invalid.

The ABC (activity based costing) cost method mainly focuses on the production and operation process, strengthens operation management, focuses on specific activities and corresponding costs, and strengthens activity-based cost management.

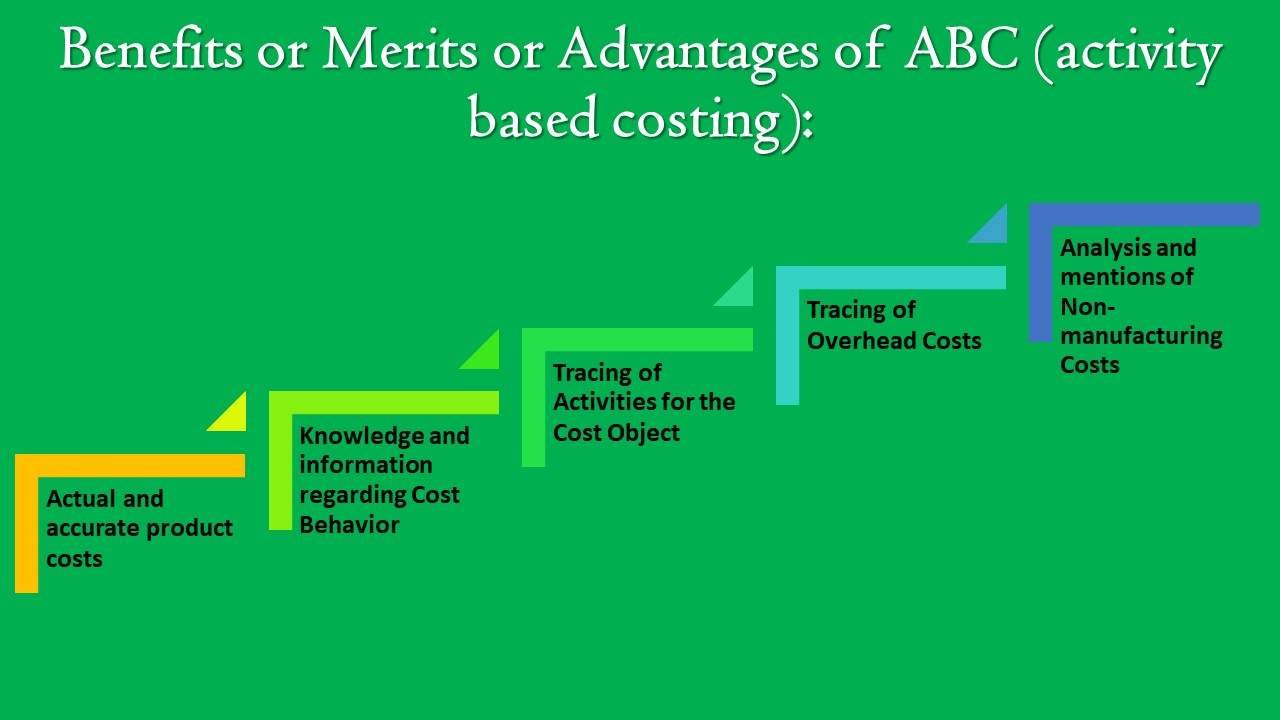

Benefits or Merits or Advantages of ABC (activity based costing):

What are the ABC (activity based costing) benefits or merits or advantages? The following ABC advantages below;

Actual and accurate product costs:

ABC brings actual, accuracy, and reliability in product costs determination by focusing on cause and effect relationships in the incurrence of the cost. It recognizes that it is activities which cause producing costs, not products and it is a product which consumes activities. In advanced manufacturing environment and technology where support functions over-heads constitute a large share of total or overall costs, ABC provides more realistic product costs. It produces reliable and correct product cost data in case of greater diversity among the products manufactured such as low-volume products, high-volume products.

Knowledge and information regarding Cost Behavior:

It identifies the real nature of cost behavior and helps in reducing costs and identifying activities that do not add value to the product, in other words producing costs. With ABC, managers can control many fixed overhead costs by exercising more control over the activities which have caused these fixed overhead costs. This is possible since the behavior of many fixed overhead costs about activities now becomes more visible and clear.

Tracing of Activities for the Cost Object:

ABC uses multiple cost drivers, many of which transaction-based rather than product volume. Further, ABC concern with all activities within and beyond the factory to trace more overheads to the products.

Tracing of Overhead Costs:

ABC traces costs to areas of managerial responsibility, processes, customers, departments besides the product costs. Costs tracing, accurate allocation of costs to various products lead to proper pricing policy. Also, Cost driver rates can use advantageously for the design of new products or existing products as they indicate overhead costs that are likely to apply in costing the product.

Analysis and mentions of Non-manufacturing Costs:

Some costs term as non-manufacturing costs; for example, product promotion or advertisement. Even though, advertising is a non-manufacturing cost which constitutes a major portion of the total cost of any product. These non-manufacturing costs can be easily allocated since the relationship between costs; and, their causes can properly understand by using ABC.

Limitations or Demerits or Disadvantages of ABC (activity based costing):

What are the ABC (activity based costing) limitations or demerits or disadvantages? The following ABC disadvantages below;

Service costs are High:

Implementing an ABC system requires substantial resources, which is costly to maintain.

Report or data collection problem:

It is a complex system which needs a lot of record for calculations.

Non-useable for small organizations:

In small organizations, the CEO or owner or managers accustom to using traditional costing systems to run their operations and traditional costing systems often use in performance evaluations. Some companies are producing only one product or a few products; so, the ABC cannot apply in there.

Activation or selection problem:

Some difficulties emerge in the implementation of the ABC system; such as the selection of cost drivers, assignment of common costs, varying cost driver rates, etc.

Different timeline of terms:

Since there are a lot of steps and groundwork required to come out with a costing based on this system, it is quite a time to consume. For example, large companies for the best costing system they produce the large size of production and give many products to us, but small or single handle company produces and give a single product. So, the large or multinational company collects many records and ABC work easy for long-term periods, as well as small organizations for difficult in short-term periods.