Importance of Cost accounting: Cost accounting is the accounting of the cost. It is made of two words-Cost and Accounting. This article explains the 7 important, the importance of Cost accounting: Management, Employees, Creditors, Investors, Consumers, Government, and National economy. The term cost denotes the total of all expenditures involved in the process of production. The shortcomings inherent in financial accounting have made the management to realize the importance of cost accounting. Whatever may be the type of business, it involves the expenditure on labor, materials and other items required for manufacturing and disposing of the product.

Here are answering the questions of What is the importance of Cost accounting?

Thus, it covers the costs involved in the production and the cost involved while receiving it. Moreover, big busyness requires delegation responsibility, division of labor and specialization. Management has to avoid the possibility of waste at each stage. Also, management has to ensure that no machine remains idle, efficient labor gets due initiative, proper utilization of by-products is made and costs are properly ascertaining.

Besides management, creditors and employees are also benefiting in numerous ways by the installation of a good costing system in an industrial organization. Cost accounting increases the overall productivity of an industrial establishment and, therefore, serves as an important tool in bringing prosperity to the nation.

Accounting, on the other hand, collects and maintains financial records of each income and expenditure and make avail of such information to the concerned officials. Thus, cost accounting is a practice and process of cost which determines the profitability of a business concern by controlling the cost with the application of accounting principle, process, and rules. Cost accounting includes the presentation of the information derived therefrom for purposes of managerial decision making.

Thus, cost accounting is an art as well as science. It is a science because it is a body of systematic knowledge having certain principles. It is an art as it requires the ability and skill with which a cost accountant can apply the principles of cost accounting in various managerial problems.

Definition:

The following definitions below are:

According to W.W.Bigg,

“Cost accounting is the provision of such analysis and classification of expenditure as will enable the total cost of any particular unit of production to be ascertained with a reasonable degree of accuracy and at the same time to disclose exactly how much total cost is constituted.”

According to R.N. Carter,

“Cost accounting is a system of recording in accounts the materials used and labor employed in the manufacture of a certain commodity or on a particular job.”

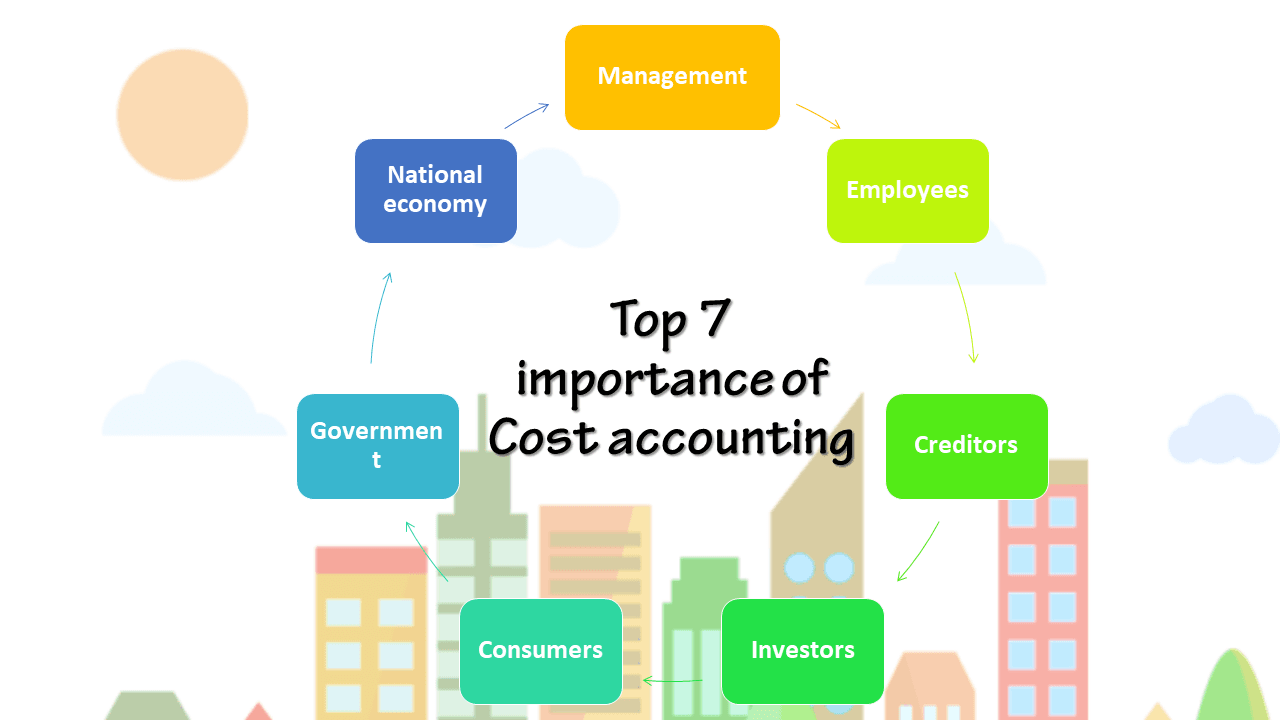

Top 7 importance of Cost accounting:

Thus, the importance of cost accounting in various spheres can summarize under the following headings:

1] Cost Accounting and Management:

Cost accounting provides an invaluable aid to management. It is so closely allied to management that it is difficult to indicate where the work of the cost accountant ends and managerial control begins. Adequate costing data help management in reaching certain important decisions such as, whether hand labor should replace by the machinery or not; whether a particular product line should discontinue or not etc. Costing checks recklessness and avoids the occurrence of mistakes.

Costs can reduce by the proper organization of the plant and executive personnel. As an aid to management, it also provides important information to enable management, to maintain effective control over stores and inventory, to increase the efficiency of the business, and to check waste and losses. It facilitates the delegation of responsibility for important tasks and ratings of employees. However, for all this, the management must be capable of using properly the information provided by the cost accounts.

The various advantages derived by managements on account of a good costing system can put as follows:

A] Useful in periods of depression and competition:

During trade depression, the business cannot afford to have leakages which pass unchecked. The management should know where economies may seek, waste eliminated and efficiency increased. The business has to wage a war for its survival. As well as, the management should know the actual cost of their products before embarking on any scheme of reducing the prices or giving tenders. The costing system facilitates this.

B] Helps in, pricing decisions:

Though economic law of supply and demand and activities of the competitors, to a great extent, determine the price of the article, the cost to the producer does play an important part. Also, the producer can take necessary guidance from his costing records.

C] Helps in estimates:

Adequate costing records provide a reliable basis upon which tenders and estimates may prepare. The chances of losing a contract on account of over-rating or the loss in the execution of a contract due to under-rating can minimize. Thus, ascertained costs provide a measure for estimates, a guide to policy, and control over current production.

D] Cost Accounting helps in channelizing production on the right lines:

Costing makes possible for the management to distinguish between profitable and non-profitable activities. Profits can maximize by concentrating or profitable operations and eliminating non-profitable ones.

E] Helps in reducing wastage:

As it is possible to know the cost of the article at every stage, it becomes possible to check various forms of waste, such as time, expense, etc., or in the use of machinery, equipment, and tools.

F] Costing makes comparison possible:

If the costing records are regularly kept, comparative cost data for different periods and various volumes of production will be available. It will help the management in informing future lines of action.

G] Provides data for periodical profit and loss accounts:

Adequate costing records supply to the management such data as may be necessary for the preparation of profit and loss account and balance sheet, at such intervals as may desire by the management. It also explains in detail the sources of profit or loss revealed by the financial accounts, thus helps in the presentation of better information before the management.

H] Costing results in increased efficiency:

Losses due to wastage of materials, idle time of workers, poor supervision, etc. will disclose if the various operations involved in manufacturing a product are studied by a cost accountant. Also, the efficiency can measure and costs controlled and through it, various devices can frame to increase efficiency.

I] Costing helps in inventory control and cost reduction:

Costing furnishes control which management requires in respect of stock of materials work-in-progress and finished goods. Costs can reduce in the long-run when alternates are tried. This is particularly important in the present-day context of global competition. Cost accounting has assumed special significance beyond, cost control this way.

J] Helps in increasing productivity:

The productivity of material and labor is requiring to increase to have growth and more profitability in the organization. Costing renders great assistance in measuring productivity and suggest ways to improve it.

2] Cost Accounting and Employees:

Employees have a vital interest in their employer’s enterprise and the industry, in which they are employed. They are benefiting in many ways by the installation of an efficient costing system in their enterprise. Cost accounting helps to fix the wages of the workers. Efficient workers are rewarding for their efficiency. It helps to induce an incentive wage plan in business. Also, they are benefiting because of systems of incentives, bonus plans, etc. They get benefit indirectly through an increase in consumer goods and directly through continuous employment and higher remuneration.

3] Cost accounting and creditors:

Investors, banks and other moneylenders have a stake in the success of the business concern and, therefore, are benefit immediately by the installation of an efficient costing system. They can base their judgment on the profitability and further prospects of the enterprise upon the studies and reports submitted by the cost accountants.

4] Cost accounting and investors:

Investors can obtain benefit fro the cost accounting. Investors want to know the financial conditions and earning capacity of the business. Also, they must gather information about the organization before making investment decisions and investors can gather such information from cost accounting.

5] Cost accounting and consumers:

The ultimate aim of costing is to reduce the cost of production to minimize the profit of the business. Reduction in the cost usually passes on the consumers in the form of lower prices. They get quality goods at a lower price.

6] Cost accounting and Government:

Cost accounting is one of the prime sources to provide reliable data to internal as well as external parties. It helps government agencies to determine excise duty and income tax. As well as, they formulate tax policy, industrial policy, export and import policy based on the information provided by the cost accounting.

7] Cost accounting and national economy:

An efficient costing system brings prosperity to the concerned business enterprise resulting in stepping up of the government revenue. Also, the overall economic development of a country takes place due to an increase in the efficiency of production. Control of costs, elimination of wastages and inefficiencies lead to the progress of the industry and in consequence of the nation as a whole.

Leave a Reply